President Bola Ahmed Tinubu has signed four new finance laws aimed at simplifying Nigeria’s complex tax system and easing the burden on ordinary citizens and businesses.

The bold reforms mark a major step in the administration’s plan to revive economic activity and make tax compliance more practical and fair.

The newly signed tax laws, which include the Nigeria Tax Act, Tax Administration Act, Nigeria Revenue Service Act, and the Joint Revenue Board Act, are expected to streamline how taxes are collected and reduce unnecessary duplication.

More importantly, they are designed to help low-income earners, small businesses, and families survive the current economic pressure.

However, the government also plans to raise its tax-to-GDP ratio from just over 10% to 18% by 2026, not by raising taxes on basic goods but by making the process more effective and inclusive.

“The reforms aim to make tax compliance easier, reduce pressure on the poor, and raise funds for infrastructure, education, and healthcare,” the presidency noted.

Under the Nigeria Tax Act, more than 50 small and overlapping taxes will be eliminated.

They will be replaced with a single, simplified code.

This is expected to save time, reduce confusion, and encourage more people to pay taxes.

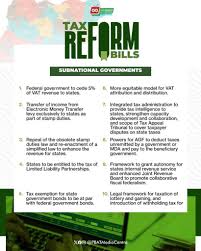

The Tax Administration Act brings uniform rules for tax collection across federal, state, and local governments.

It will help curb over-taxation and duplication, which many small business owners have long complained about.

Meanwhile, the Nigeria Revenue Service Act replaces the Federal Inland Revenue Service (FIRS) with a more independent and streamlined Nigeria Revenue Service (NRS).

The agency will have a clear mandate to be efficient and transparent.

In addition, the Joint Revenue Board Act will improve coordination across all government levels.

It also introduces a Tax Ombudsman and a Tax Appeal Tribunal to handle complaints and disputes.

Nigerians earning ₦1 million or less annually will now enjoy a ₦200,000 rent relief, reducing their taxable income.

This group will also be exempt from income tax, bringing much-needed relief to workers and small traders.

Families will benefit as food items, healthcare, rent, electricity, baby products, and education services are now VAT-free.

Small businesses earning less than ₦50 million per year will no longer pay company income tax and can file simpler tax returns.

This is expected to reduce costs and paperwork for entrepreneurs.

“Essentials like food, healthcare, baby items, education, rent, and electricity will now be VAT-free,” the law provides.

Large companies are also seeing benefits. Their corporate tax rate will drop from 27.5% to 25% by 2025, and they will receive VAT refundson legitimate expenses.

However, the gains come with stricter compliance rules.

The changes will affect high-income earners and buyers of luxury goods.

Capital gains tax will apply to large stock sales, and VAT on luxury items will increase. This ensures that wealthier individuals contribute more.