Nigeria’s total public debt could soon exceed ₦180 trillion, following fresh loan requests submitted by President Bola Ahmed Tinubu to the National Assembly.

If approved, the move would push the nation’s borrowing to a historic level and stir fresh concerns about fiscal sustainability.

The president’s request, read separately by Senate President Godswill Akpabio and House Speaker Tajudeen Abbas during plenary, includes an external loan of \$21.5 billion — around ₦33.39 trillion at the official rate of ₦1,590 per dollar.

In addition, Tinubu asked lawmakers to approve ₦757.9 billion in domestic bonds.

These bonds are expected to cover outstanding liabilities under the Contributory Pension Scheme (CPS).

According to the president, borrowing is now necessary to address urgent national needs.

“The 2025–2026 borrowing plan covers all sectors,” he wrote, “with specific emphasis on growth, employment generation, and poverty reduction.”

Tinubu further explained that the fuel subsidy removal and ongoing revenue gaps have made borrowing a realistic approach to keep the country going.

“In light of the significant infrastructure deficit and declining resources, prudent economic borrowing is essential to close the financial shortfall,” Tinubu added.

Tinubu also addressed the issue of unpaid pensions.

He admitted that revenue shortages had made it difficult for the federal government to meet its pension obligations, which has affected the lives of many retirees.

“The Federal Government has not fully complied with the PRA 2014, leading to growing pension arrears and suffering for retirees,” he said.

He assured the National Assembly that issuing pension bonds would help settle the growing backlog.

“This move will enable retirees to meet their basic needs, improve health, and avoid untimely death,” the president stated.

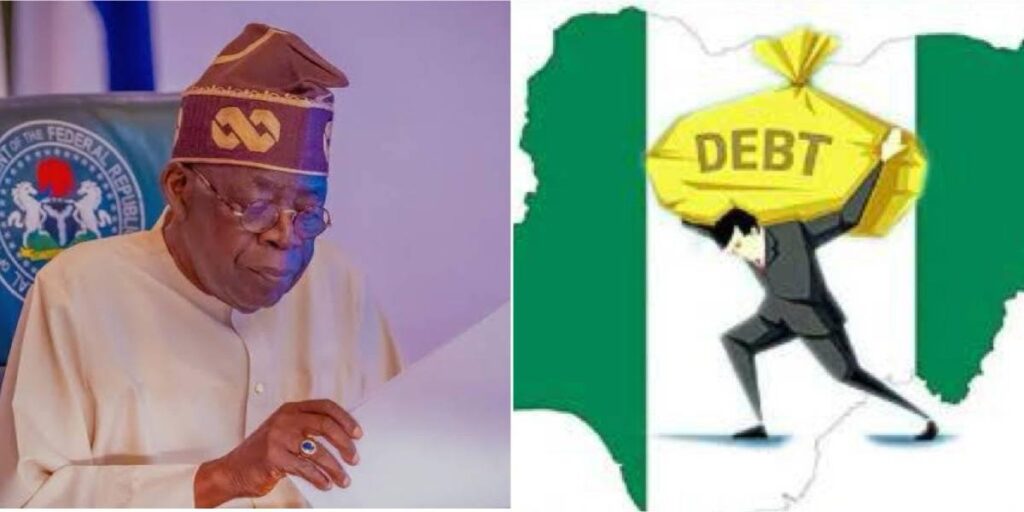

Moreover, the government has already borrowed ₦10.85 trillion between January and April 2025. Nigeria’s public debt jumped from ₦97.34 trillion in 2023 to ₦144.66 trillion by the end of 2024 a 49% increase.

In that period, the government spent ₦1.399 trillion on debt servicing, while total revenue stood at just ₦1.067 trillion.

The gap is alarming and signals the risk of financial strain if spending continues unchecked.

Tunde Abidoye of FBNQuest cautioned: “Some caution is needed, given the rising debt service cost and risks tied to foreign loans. This could shrink Nigeria’s fiscal space.”

Olatunde Amolegbe, former president of the Chartered Institute of Stockbrokers (CIS), agreed that borrowing may be necessary but stressed the importance of proper fund management.

“Borrowing isn’t the issue — it’s whether we have the capacity and discipline to repay and use the funds wisely,” he said.

He added that pension bonds had been used in the past, noting, “The pension bond should provide quick relief to retirees, while the government handles repayments over time.”

Furthermore, economic analyst Clifford Egbomeade said the pension clearance may encourage domestic spending.

However, he warned that “if used properly and tied to growth sectors, the loans could support development.

But Nigeria’s already-high debt demands careful planning to avoid more strain.”

While this fresh loan request raises many questions, it also holds the potential to bring long-needed reform and development.