Starting January 1, 2026, all taxable Nigerians and businesses must obtain a Taxpayer Identification Number (Tax ID)to access banking, financial services, and government contracts.

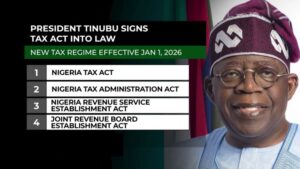

The requirement follows the signing of the Nigeria Tax Administration Act, 2025 by President Bola Tinubu.

The legislation is designed to expand Nigeria’s tax base, reduce evasion, and strengthen public revenue.

For the first time, even non-residents providing taxable goods or services in Nigeria are mandated to register for a Tax ID.

According to Part II, Section 4 of the Act, “Every taxable person shall register with the relevant tax authority and obtain a Taxpayer Identification Card (Tax ID) for the purpose of compliance with tax obligations.”

This provision also applies to all government ministries, agencies, and departments at federal, state, and local levels.

One of the most significant provisions is Section 8, which makes a Tax ID a prerequisite for bank accounts, insurance, stocks, and government contracts.

Therefore, anyone wishing to do business with the government or participate in financial services will need a valid ID.

Moreover, Section 7 (3) empowers tax authorities to issue an ID to individuals or entities who fail to apply.

However, authorities may also deny issuance based on available records but must notify applicants within five working days.

For businesses that stop operations, the Act allows for suspension or deregistration of the Tax ID.

If a company temporarily halts activity, its ID may be marked “dormant.”

Permanent closures, on the other hand, require deregistration within 30 days of notification.

The Act further creates the Nigeria Revenue Service (NRS) as the new central tax body.

The Executive Chairman will head the Governing Board for a renewable four-year term.

The Board will feature representatives from the Ministry of Finance, Central Bank, Corporate Affairs Commission, Customs Service, and other key government agencies.

Funding for the Service is secured under Section 22 (a), which permits it to retain 4 percent of revenues collected, excluding petroleum royalties.

Nigeria currently has one of the lowest tax-to-GDP ratios in Africa below 10 percent compared to South Africa’s 25 percent.

With oil revenues shrinking, the Tinubu administration is banking on broader taxation to sustain the economy.

Meanwhile, government officials insist that the reform will promote fairness.

“The compulsory Tax ID is part of wider efforts to curb tax evasion, formalize more of the economy, and strengthen Nigeria’s revenue base,” the Act states.